Normally, these discount rates are at least 10% as well as some insurance firms use the discounts to both the car and the homeowners/renters plan. It's no secret that the much better your driving record, the much less you will certainly pay for vehicle insurance policy.

Several car insurance providers are really a collection of numerous insurance coverage companies in which each satisfies a specific kind of chauffeur. The most awful drivers go in one business, the ideal in an additional, and a great deal of individuals end up in one of the center business - perks. These middle people pay much less than the most awful vehicle drivers, but more than the most effective.

No one told them which insurance firm in the team had the ideal costs. As well as, odds are, no one also informed them there was a team of insurance policy business. If you have a spotless driving record, there's no reason you should not be paying the lowest price a group of insurance coverage business has to provide.

prices insurance affordable insurance auto insurance

prices insurance affordable insurance auto insurance

Talk to your agent. And remember, be a secure driver (cheap car). It will certainly conserve you money. Do you drive to and from work? If you do, you are literally paying a premium to do so. Insurance policy companies charge you dramatically higher costs if you drive to function. And also, the longer your commute (in miles, not minutes), the greater the costs.

Yes, there's a price there, also - auto insurance. But you will enjoy the financial savings of gas and reduced insurance coverage expenses. Usually, people drive 1,000 to 1,250 miles a month. That is what insurer take into consideration ordinary use. If you drive much less than the average, you could be qualified for low-mileage price cuts, which some insurance firms supply.

Our How To Reduce Your Auto Insurance Premiums Statements

Typically, the much more city the area, the higher the costs. The costs can differ also within a neighborhood. Rates can vary significantly from state to state. If you're residing in New Jacket, Massachusetts or Hawaii, you're paying a number of times more, typically, than you might in North Dakota, South Dakota or Idaho.

If those numbers incorporated are extra than 10 percent of your potential payment (the worth of your cars and truck minus the cost of your insurance deductible), it's time to take into consideration dropping them from your insurance coverage. This research can Helpful resources be extremely time consuming, however the financial savings can accumulate, both instantly and also gradually (auto).

End up being a discerning consumer Currently that we've looked at both prompt as well as extensive ways to minimize your present policy, there's still an additional option to evaluate. Change insurance policy business altogether. insured car. Less than 25 percent of all motorists really take the time to shop their insurance plan on a regular basis.

How can different insurance policy business supply the same protection on the exact same lorry in the exact same state for much less? Not all insurance business gauge threat in the very same means, so you might be a risky with one company and a medium-risk with one more.

Your credit score score might be taken into account with one company yet not with another. It's worth the time to do your research as well as find out what various other business bill.

How How To Lower Your Car Insurance Premium - Incharge Debt ... can Save You Time, Stress, and Money.

cheapest car cheaper money insurance affordable

cheapest car cheaper money insurance affordable

While some firms might offer "commitment discounts," those can be offset by annual rate increases (credit score). If you aren't happy to take your company in other places, insurer will certainly make the most of that. The Geek, Budget study had two vital findings: American drivers are overpaying their car insurance policy by a standard of $368 each year.

How to find the plan that's ideal for you Start by evaluating your existing policy coverages to determine just how much coverage you actually need. While this is time consuming, you may find some terrific means to reduce your current plan premium immediately, prior to you begin going shopping around. Cast a vast web in seeking a brand-new plan.

vans auto cheaper cars trucks

vans auto cheaper cars trucks

, to obtain a feeling of what to anticipate. Keep in mind though, that the only way to get a truly precise rate quote is to speak with an insurance agent directly.

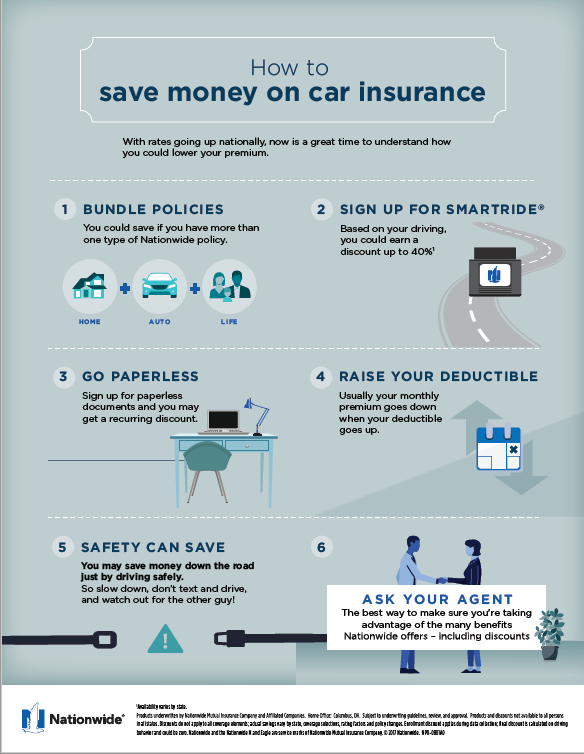

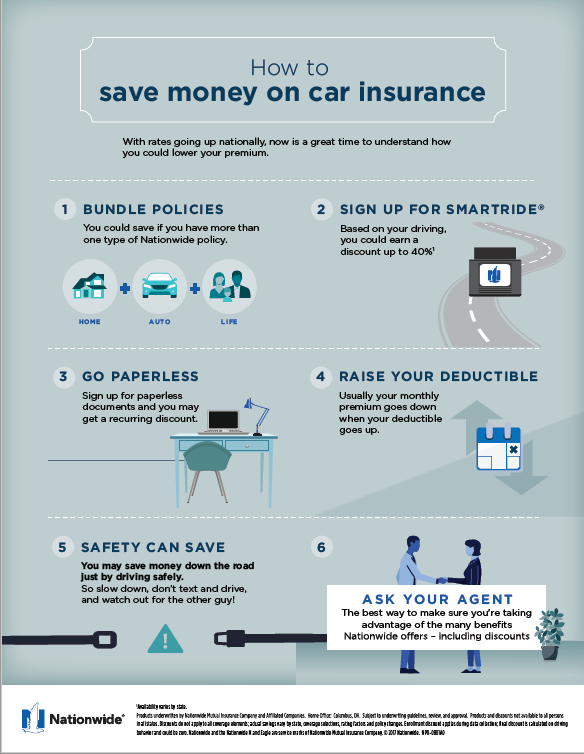

Ask concerning packing your policies as this can cause even bigger price cuts. Integrate your car insurance with your home owner's or occupant's insurance (insure). Vehicle insurance policy is the riskiest insurance for companies to offer, so packing it with a plan you're less most likely to utilize makes it a lot more enticing for insurer to provide a deep discount rate.

If you discover a good deal with another insurance coverage firm, call your present insurer and ask if they can match it (insure). Possibly they're able to or perhaps they're not; regardless it deserves the time to ask. If your existing firm will quote a far better offer, it will conserve you the moment and also inconvenience of changing business.

Some Ideas on How To Save On Car Insurance Amid ... - Fox6 News Milwaukee You Should Know

Consider a different automobile Ultimately, there's one last choice to take into consideration; getting a various automobile. Insurance coverage companies track which car versions, and even cars and truck colors, are much more most likely to be involved in a crash or an insurance coverage claim.

And red automobiles are more probable to be associated with crashes. According to another Nerd, Budget study, the most inexpensive cars and trucks to insure tend to be sporting activity energy vehicles large, secure, non-flashy vehicles. If your cars and truck insurance costs are ruining your budget despite which business you make use of, take into consideration trading your cars and truck in for something safer and less costly to guarantee.

It may spend some time, but the overall cost savings can be well worth it. cheap car. Be sure to keep track of the protections provided and premiums priced quote with each business you speak to so you can track them equally as well as make certain you're getting the most effective bargain. Start with your current plan, detailing out your coverages and also the costs you pay for every one.

When you establish the insurance coverage you need, start going shopping about with various other business to locate the finest quote for the same insurance coverages. If you discover a better rate, see if your current company can match it.

Automobile insurance policy sets you back even more than $1,500 annually for the average vehicle driver. However you can lower your automobile insurance rates by making use of a few very easy means to save - auto. As an example, you might cut your auto insurance coverage expense by 10% just for switching over to paperless expenses or establishing autopay.

How What Affects Car Insurance Premiums - State Farm® can Save You Time, Stress, and Money.

car insurance cheaper cars auto cheaper auto insurance

car insurance cheaper cars auto cheaper auto insurance

Reconsider your insurance coverage An additional easy means to lower your auto insurance policy costs is to very carefully go through your plan and also remove any kind of insurance coverage you don't require or make use of. insurance company. You might not require roadside help protection on a new car that's still under guarantee considering that many suppliers provide complimentary roadside aid for the initial 3 to 5 years - dui.

And also jumping from a $500 to $1,000 deductible could assist you lower the price of protection by 25%. Note that you'll need to pay even more expense for car repair services after an at-fault accident or when making an extensive case, so this alternative is ideal for chauffeurs with a healthy and balanced emergency savings fund.

Bundle your insurance coverage You can save between 5% as well as 18% on your yearly automobile insurance coverage costs when you with the same company. That can consist of auto and also residence, renters, condominium, umbrella, life or wellness. The most usual package is automobile plus house insurance policy, and also generally saves you 15% off auto insurance coverage and also as much as 35% on home insurance coverage yearly.

Maintain young vehicle drivers on a parent's plan Having a young chauffeur on their moms and dads' plan generally causes a lot reduced vehicle insurance prices (credit score). Contrasted to the expense of insuring a by themselves policy, we located that including young chauffeurs to their moms and dads' strategy can save 66% on automobile insurance policy.

Improve your credit rating Your credit report rating is one of the factors that impacts your car insurance policy prices. Bumping your up to the following rate conserves most drivers a standard of 16% to 17% on their annual car insurance prices, according to our research study - insurance.

Everything about 16 Ways To Lower Your Auto Insurance Premium - Insuramatch

insurance affordable liability car insurance car insurance

insurance affordable liability car insurance car insurance

Compare vehicle insurance policy prices estimate Looking for several quotes is the easiest method to find reduced automobile insurance policy rates. We discovered that to locate the most inexpensive policy can save you as much as 50% on your yearly vehicle insurance prices contrasted to choosing an insurance company with ordinary prices. Insurance firms consider a number of components when setting rates, meaning the cheapest company for you may vary depending upon your driver profile (cheaper auto insurance).

When is the very best time to get car insurance policy? It's a good idea to obtain brand-new quotes after a life occasion like marrying or when you struck an age turning point like age 18, 21 or 25, given that those adjustments can lower your prices - cheaper car. You can at any moment without fines from many firms, as long as you do not have a lapse in insurance coverage when you switch to your brand-new plan.

Insurance companies usually will not see those adjustments until you go to renew, so it's usually best to wait until renewal and then get a few quotes to see which company is most forgiving as well as offers the ideal prices. auto.